Navigating Financial Dilemma: What Drives Individuals to Declare Bankruptcy

Nowadays, we do feel that the cost of living is above what we earn, so we find ways to keep up with our needs. Some of us consider filing bankruptcy to not just keep up with our needs but also to give ourselves a chance to restart financially. In this post, we will discuss what are the common reasons for bankruptcy.

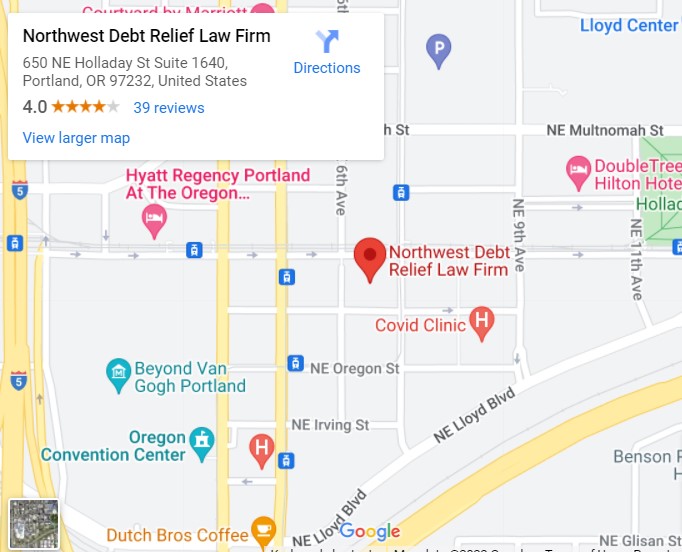

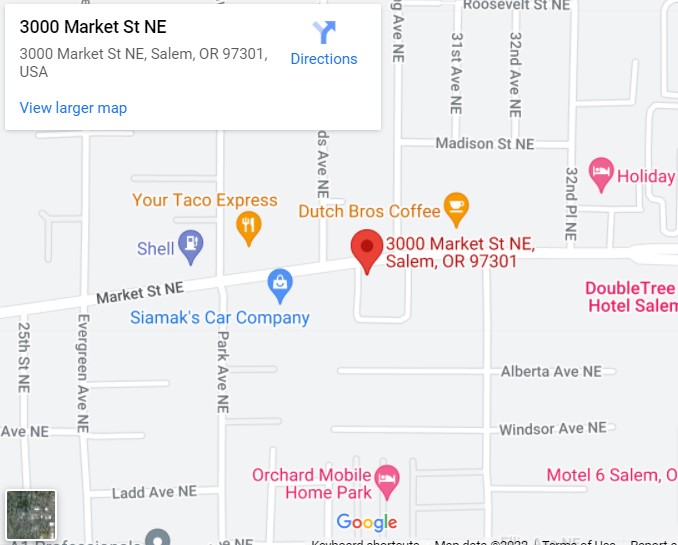

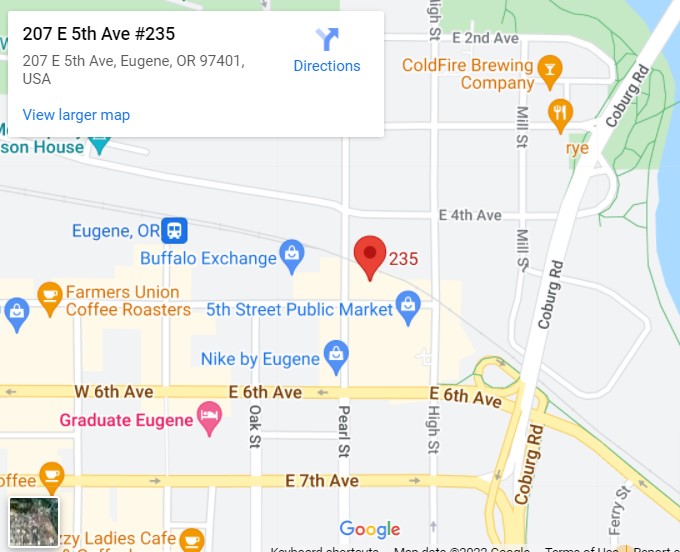

Dealing with financial difficulty alone, which pushes us to consider filing for bankruptcy can be manageable with oneself. Still, in reality, bankruptcy law is a vast and deep topic in which individuals planning to file bankruptcy need to be made aware and updated. This is where Oregon bankruptcy lawyers pop into the picture.

At Northwest Debt Relief Law Firm, we understand that filing bankruptcy can be overwhelming. Our Portland bankruptcy attorneys are here to guide you through the whole bankruptcy process and help you get a fresh start. Contact us today, we offer free debt solution consultations.

What are Common Reasons People File for Bankruptcy?

Although bankruptcy is frequently perceived negatively, it can actually be a vital financial tool for people who are dealing with enormous hardships. People frequently declare bankruptcy as a preemptive measure to start over and reconstruct their lives. The opportunity to manage debts, lessen the weight of unmanageable financial responsibilities, and regain control over one’s financial destiny are all provided through this approach.

With the ability to face financial hardship head-on and pave the path for a more secure and bright future, declaring bankruptcy can help those who are struggling with unanticipated expenses such as medical bills, unemployment, or other unforeseen events.

Financial Mismanagement

The leading cause of bankruptcy is excessive expenditure and credit utilization. Although excessive spending or improper credit card use may have contributed to your debt problem initially, we frequently find that one of the aforementioned factors is what pushes people over the edge. An unforeseen incident, such as an illness, job loss, or divorce, can push an already precarious scenario to the breaking point when you have a lot of debt and insufficient funds to fall back on.

Making a budget can help you keep track of your income and expenses and ensure that you spend no more than you get. This is the greatest strategy to prevent financial mismanagement. Additionally, it’s critical to create a savings strategy for expenses that can result in further debt.

Credit Problems

Many people spend money they don’t have since credit cards and installment loans are so widely available. Some people can find themselves unable to pay even the minimum amount due on these debts if this activity spirals out of control. While a debt-consolidation plan or home equity loan may assist in managing these bills in the short term, many people who select these options end up declaring bankruptcy at some point.

Medical Costs

Anyone, at any time, can suffer from a serious sickness or accident, which can cost them hundreds of thousands of dollars in medical expenses. The only remaining course of action for dealing with these debts may be bankruptcy once savings, student money, retirement accounts, and home equity have been depleted.

Separation or Divorce

Divorce can be an incredibly expensive process from beginning to end. Before adding the costs of alimony and child support, as well as the added expense of maintaining two separate houses, legal fees can be costly for both parties. Wage garnishment may occur if a person is unable (or unwilling) to pay alimony or child support, making it even less likely that they will be able to pay off all of their debts. The recipient may potentially find themselves in danger financially if one side refuses to make these payments.

Loss of Employment

Financially, it can be terrible to lose a job. The majority of bankruptcy filers who have lost their jobs did not have these safety nets in place, although some may have an emergency fund on hand or get a severance payout.

An unemployed person’s meager finances are depleted by the loss of insurance protection and the price of individual insurance. The job seeker could become insolvent if they have a prolonged term of unemployment due to falling behind on their obligations.

Unexpected Emergencies

Lack of insurance and emergency funds can push people into bankruptcy in the event of natural catastrophes like tornadoes, hurricanes, or earthquakes, as well as in cases of property loss due to theft. Many people are unaware that certain natural calamities, like earthquakes, necessitate the purchase of specific insurance in order to recover losses. Uninsured people may have to pay for temporary housing, food, and the replacement of valuables that were lost in the disaster. In particular, people who lose their clothes can discover that they are unable to dress professionally for work, which could result in a possible loss of income.

There are still other reasons why people file for bankruptcy because we encounter situations in different ways. Not knowing bankruptcy law is something we do not need to be afraid of. Oregon bankruptcy lawyers like Northwest Debt Relief Law Firm, are reliable and skilled to guide and help you deal with bankruptcy.

How To Avoid Bankruptcy?

Avoiding bankruptcy has become a significant objective for both individuals and organizations in the current difficult financial landscape. Although the prospect of bankruptcy can be frightening, it is possible to avoid this difficult situation with careful planning, wise judgment, and prudent financial management. People can protect their financial stability and work toward a more secure and debt-free future by taking responsible actions and taking a proactive approach to managing their finances.

Create a Budget

Create a thorough budget that details all of your costs and income. By doing so, you’ll be able to see where your money is going and find places where you may make savings.

Cut Unnecessary Expenses

Examine your spending and note any unnecessary expenses you may cut or eliminate. This can entail cutting back on eating out, canceling unwanted subscriptions, or figuring out more affordable ways to satisfy your demands.

Negotiate with Creditors

Contact your creditors and let them know you’re having trouble paying your debts. They might be open to bargaining for reduced interest rates, longer payment terms, or even partial debt forgiveness.

Debt Consolidation

Take into account combining all of your high-interest loans into a single, lower-interest loan. By doing so, you can consolidate your debt and pay less interest overall.

Credit Counseling

Sign up for credit counseling courses provided by respected nonprofits. These programs offer financial knowledge and can assist you in creating a debt repayment strategy.

Emergency Fund

Create an emergency fund to pay for unforeseen costs. Having a reserve of money can prevent you from turning to credit cards or loans when things go rough.

Prioritize Debts

If you have several debts, order them according to terms and interest rates. Make minimum payments on other obligations while concentrating on paying off high-interest loans first.

Know The Common Reasons For Bankruptcy, Call Our Portland Bankruptcy Attorney Now!

Dealing with financial issues and clinging to the idea of filing bankruptcy is something not uncommon as we are all facing different struggles as well. However, dealing with bankruptcy without full knowledge about what you are entering is not advisable as bankruptcy itself in the legal world is a vast and deep topic. This is where our Oregon bankruptcy lawyers come into the picture, we will guide you from the beginning until the end of the bankruptcy process.

Our legal team at Northwest Debt Relief Law Firm is reliable and knowledgeable about bankruptcy law; we will help you understand the common reasons for bankruptcy. If you’re dealing with unmanageable debt and not sure what to do, let our Portland bankruptcy attorneys help you.

We provide free debt solution consultations. Our Oregon bankruptcy lawyers can also help you with concerns about After Bankruptcy, Repaying Debts and Debt Discharge. Call us now!