If you experience financial problems that make you unable to pay the money that you owed to a creditor, declaring bankruptcy may be your last option to seek debt relief. Bankruptcy will allow you to reorganize your finances, pursue debt settlement, and pay off a creditor. Different types of bankruptcy will help you manage your finances and pay your debts.

There are two different types of debt: secured debts and unsecured debts. Secured debt is a type of debt backed by collateral to reduce the risk associated with lending. It is often associated with borrowers that have poor creditworthiness. If you have a good credit history, you will have higher chances of loan approval. Because the risk of lending to an individual or company with a low credit rating is high, securing the loan with collateral significantly reduces that risk.

If the borrower on secured loan defaults on repayment, the bank will seize the collateral, liquidate and sell it, and use the proceeds to pay back the borrowed money. Assets backing debt or a debt instrument are considered as a form of security, which is why unsecured debt is considered a riskier investment than secured debt.

Secured credit is created with liens. It provides a lender with added security when lending out money. A lien is classified as a voluntary lien or involuntary lien. An experienced Oregon bankruptcy attorney can help you understand how the liens affect your bankruptcy filing.

A voluntary lien is a type of lien where the owner of a property consensually grants another party legal claim to the property as security for the repayment of a debt. The debtor voluntarily grants the lien to the lender, and the property is used as collateral. For example, when you apply for a housing loan, you will be required to sign a deed of trust or a mortgage. This agreement serves as proof that you grant the lender a lien or security interest for your property. If you fall behind on your monthly payment, then the lien will be used to allow a foreclosure auction.

A lien can be granted to a lender against your personal property through a security agreement. This includes equipment, vehicles, furniture, inventory, tools, stock shares, cash, other investments, or anything that you possess that is not a real estate property. Types of loans such as car loans and home mortgages are secured debts with a voluntary lien. When you apply for a car loan, you will be required to sign and authorize a security agreement that grants a lien against the car that you will buy. If you fail to repay according to the payment plan, the lender can repossess the car using the voluntary lien.

A lien can be granted to a lender against your personal property through a security agreement. This includes equipment, vehicles, furniture, inventory, tools, stock shares, cash, other investments, or anything that you possess that is not a real estate property. Types of loans such as car loans and home mortgages are secured debts with a voluntary lien. When you apply for a car loan, you will be required to sign and authorize a security agreement that grants a lien against the car that you will buy. If you fail to repay according to the payment plan, the lender can repossess the car using the voluntary lien.

On the other hand, an involuntary lien may be imposed by the court, often for non-payment of taxes. The involuntary lien gives the tax authority (or other body) the right to confiscate one’s property if the debt is unpaid. It includes mechanic’s liens, income tax or real estate liens, judgment liens, and landlord liens.

Secured creditors can protect their collection rights by perfecting a lien. In legal terms, “perfection” refers to a mandatory action to give a creditor notice of lien depending on the applicable state law and property type. A perfected lien provides legal documentation to prove that a creditor has a legal right to seize a collateralized property in place of payments for which they are owed.

In most states, a lender can perfect a lien for a real estate property by filing or recording deeds of trusts and mortgages in the same location of that property. For vehicles, lenders may perfect the liens against motorcycles, trucks, and cars by filing a notation on the certificate of title with the state motor vehicle department.

To perfect a lien for tangible personal properties such as furniture, equipment, tools, materials, and goods, a financing statement must be filed. It is a legal document or record that recognizes the lender, the borrower, and the collateral for secured debts. A financing statement can be filed by a creditor even without a signature, as long as the debtor has signed the agreement for the collateral.

A lender needs to perfect a lien. Some borrowers are granting liens to multiple creditors against the same property. For instance, home equity lines of credit are typically considered as junior to the home loan that you have taken. If the owner of the mortgage is unable to perfect the secured interest, the junior lien can move up in priority.

Lenders might face serious consequences if they fail to perfect a lien. If you decide to file for bankruptcy, the court can disregard a lien that was not perfected properly. In this case, the lender will be considered as an unsecured creditor.

Secured and unsecured debts differ from one another in terms of how a creditor can impose his or her rights to collect, in case you are unable to make monthly payments on time. A credible Oregon bankruptcy attorney can help you classify your assets as secured or unsecured. When you deal with unsecured debts, a creditor is required to file a lawsuit in bankruptcy court before they seize your assets or property.

In contrast, a secured creditor can immediately enforce rights when you fall behind your loan debt and have not yet declared bankruptcy. A court order is not required before the repossession of any car or motor vehicle; however, secured creditors are not allowed to breach the peace or to trespass on any private property.

A lender can impose a home mortgage by foreclosing the deed of trust. Some states allow foreclosure even without any legal action from the bankruptcy court and it can be accomplished within a couple of months. In some states, foreclosure may require approval from the bankruptcy court, therefore the process may take longer.

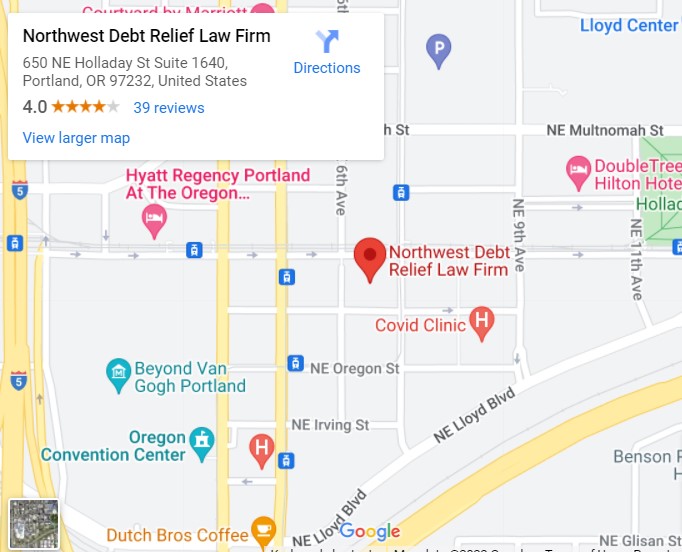

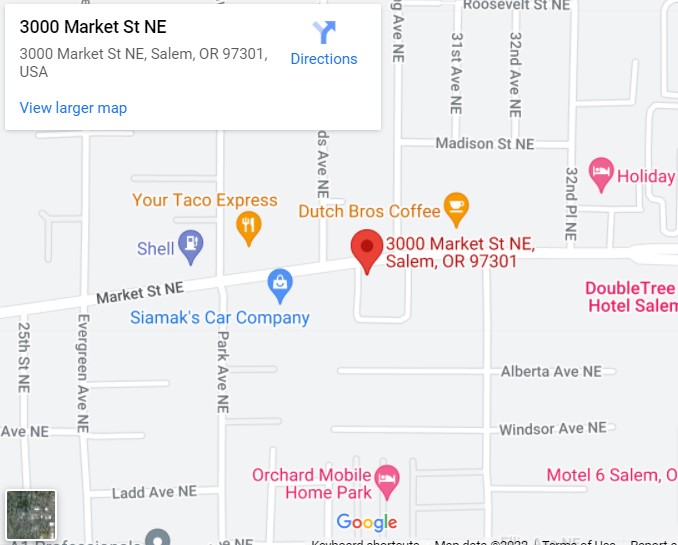

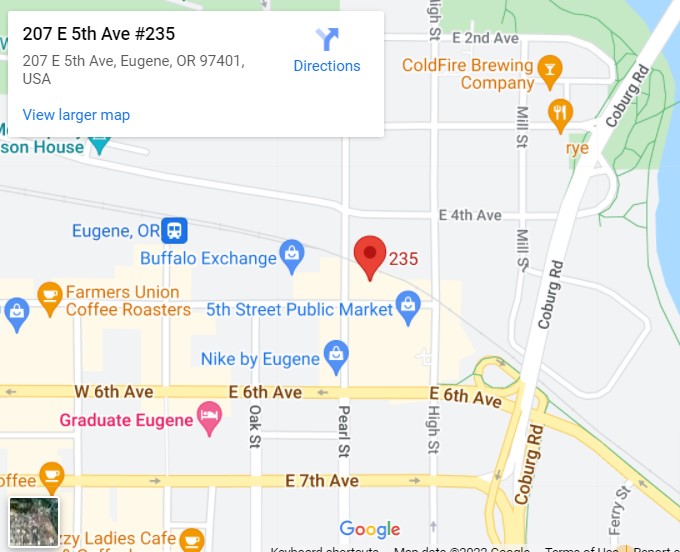

Before you declare bankruptcy, it is important to know and understand how the bankruptcy process and bankruptcy exemptions will solve your debt problems. Credit counseling can give you an in-depth understanding of the importance of debt management. For legal help in filing for bankruptcy, do not hesitate to consult our qualified Oregon bankruptcy lawyers at Northwest Debt Relief Law Firm. Our lawyers will guide you on how to file your bankruptcy forms, prepare your paperwork for the bankruptcy filing, negotiate settlements to reorganize a repayment plan, help you get out of debt, and improve your credit score according to the bankruptcy laws.