Portland Bankruptcy Attorneys

Get Affordable Bankruptcy Representation Now!

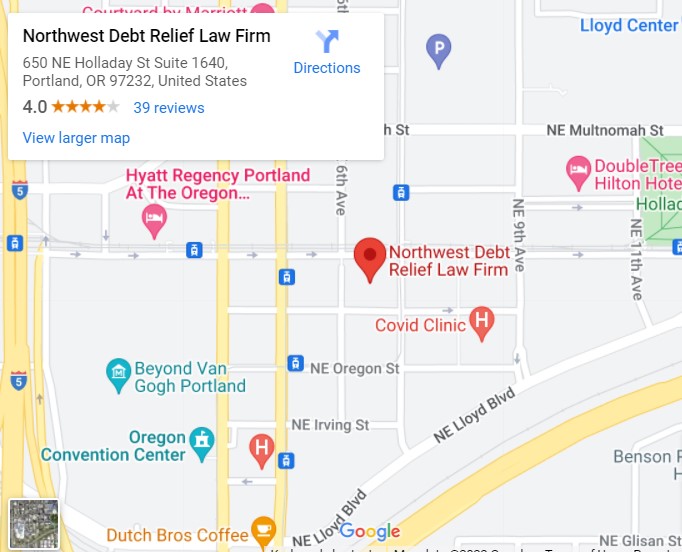

Your Trusted Portland Bankruptcy Lawyers

Our Bankruptcy Attorneys Overcome Common Obstacles

If you’re dealing with unmanageable debt and not sure what to do, let our attorneys at Northwest Debt Relief Law Firm help you. We believe that everyone deserves a fresh start in life, and we will do our best to help you get your financial health back on track!

Our Oregon bankruptcy attorneys will take the time to answer your questions so you can get some peace of mind. We can help remove the stress and burden of your debt problems today.

Chapter 7 Bankruptcy

Got too much debt? If you’re suffering from unmanageable debt, filing bankruptcy can help you get your life back on track. Chapter 7 bankruptcy enables you to wipe out your unsecured debts. Break free from debt and get a fresh start in life! Call our Oregon bankruptcy law firm to determine if you’re eligible for Chapter 7 bankruptcy.

or Call Us Today! (503) 487 -8973

We’re Bankruptcy Attorneys Dedicated to Your Financial Success.

At Northwest Debt Relief Law Firm, we understand that filing bankruptcy can be overwhelming. Our Portland bankruptcy attorneys are here to guide you through the whole bankruptcy process and help you get a fresh start.

or Call Us Today! (503) 487 -8973

Schedule A Free Debt Solutions Consultation

Discuss all of your options with an Oregon Bankruptcy Attorney. We’ll take the time to answer your questions to get you some peace of mind. Remove the stress and burden of your debt problems today!

or Call Us Today! (503) 487 -8973

Are your debts keeping you up at night?

At Northwest Debt Relief Law Firm, we provide a comprehensive and highly-personalized solution to your debt problems. Our bankruptcy attorneys in Portland, Oregon are dedicated in providing you with the best results possible. Talk to our Oregon bankruptcy attorney to restore your peace of mind today!

or Call Us Today! (503) 487 -8973

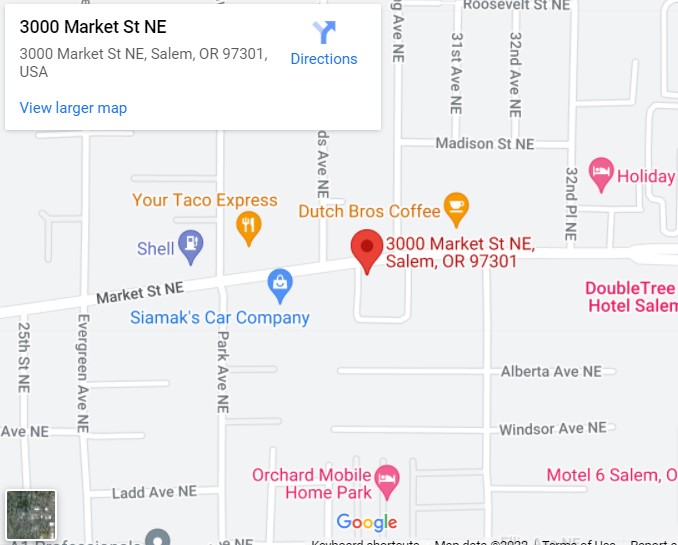

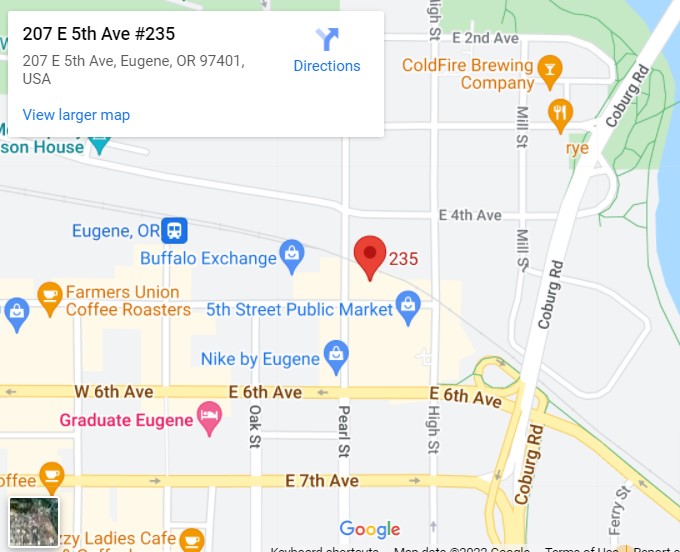

What Your Neighbors in Portland, Salem, Medford & Eugene Say About Our Bankruptcy Attorneys

Frequently Asked Questions

Oregon Bankruptcy Information

Can I Get a Credit Card After Bankruptcy?

Bankruptcy and Credit Cards: What You Need to KnowBankruptcy is a tough journey, often marked by financial stress and uncertainty. However, it's not the end of the road but rather a new beginning towards financial [...]

Stopping Car Repossession with a Georgia Bankruptcy Attorney

How Bankruptcy Can Stop Repossession and Get You Back on Track Are you worried about losing your car because you're struggling with debt? You're not alone. Car repossession can be a scary and stressful [...]

Student Loan Bankruptcy in Portland, OR

Using Bankruptcy as Financial Relief for Student Loans Student loans often stand as a significant burden for many individuals. The prospect of addressing these loans through bankruptcy can be daunting. Yet that is a topic [...]