Filing bankruptcy is often seen as a last resort for people experiencing financial difficulties. Declaring bankruptcy may provide you with an opportunity to get your finances in order, and potentially even a clean slate—but it also has negative consequences that can impact your assets and make it hard to get approved for credit for years.

Many companies provide forms and booklets that people can use to file for bankruptcy on their own. However, bankruptcy laws may be confusing, and mistakes can sometimes mean that you still owe money on bills that you believed were discharged. As such, it is advisable to get the advice of an experienced bankruptcy attorney.

Additionally, bankruptcy can affect your chance to purchase a vehicle, a home, or other properties for at least 10 years. A bankruptcy attorney can advise you on whether filing for bankruptcy is the best option for your particular circumstances.

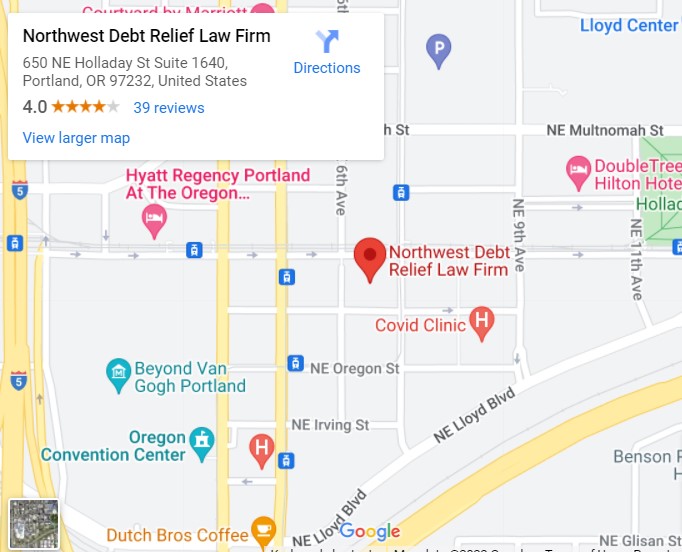

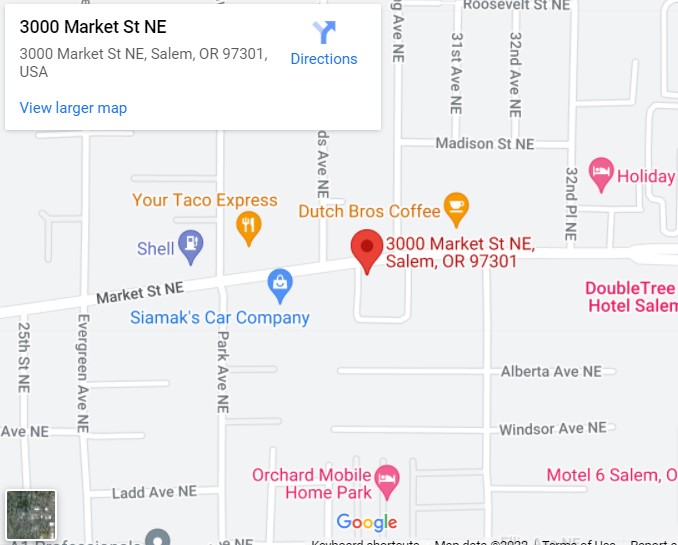

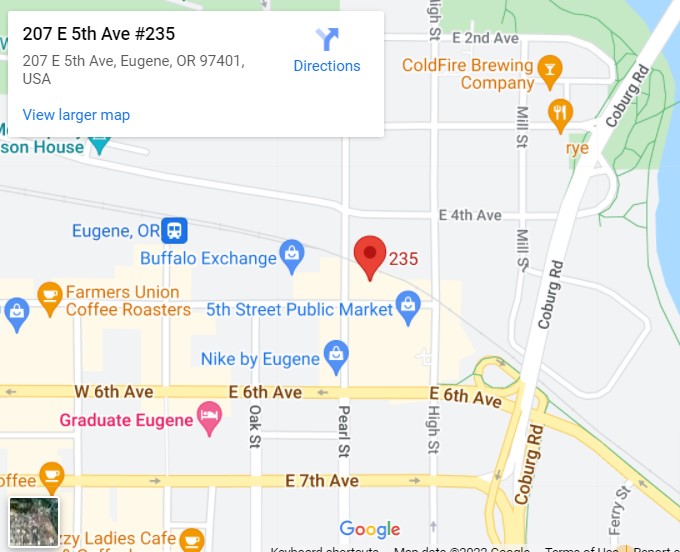

If you want to learn more about bankruptcy or get help with a bankruptcy case, you should speak with one of our Salem bankruptcy lawyers at Northwest Debt Relief Law Firm for legal advice.

Our bankruptcy attorney will take the time to answer your questions so you can have peace of mind. We can reduce the stress and burden of your financial problems right now.

Bankruptcy Law And Bankruptcy Exemptions in Oregon

Bankruptcy is the legal process that happens when a person or company is unable to pay an outstanding debt to their creditor (credit card debt, mortgage debt, medical debt, student loan). Filing bankruptcy helps those who have been enslaved by debt to find freedom from their financial liabilities while also helping creditors in recovering part of their money through the sale of assets or repayment programs.

All bankruptcy cases in Oregon are governed by the US Bankruptcy Code and conducted in federal court. As such, bankruptcy filing in Oregon is largely similar to filing in any other state. However, Oregon bankruptcy laws come into play as well, influencing the debtor’s exemption privileges and what property is protected.

During the bankruptcy process, the courts will appoint a trustee whose responsibility is to ensure creditors recover the maximum amount of money due while relieving the debtor of their financial burdens. In many circumstances, this entails dissolving assets and property that are not protected by Oregon bankruptcy exemptions to pay off the creditors. Any outstanding debts are then erased.

A structured repayment plan spanning three to five years, on the other hand, can help the debtor manage their financial responsibilities and provide them time to pay off their debts. Please keep in mind that there are some debts that you will not be able to wipe out in bankruptcy.

The U.S. Bankruptcy Code is grouped into chapters, each of which defines and details the legal processes for certain kinds of bankruptcies. The vast majority of cases come under Chapter 7, Chapter 11, or Chapter 13, which are all detailed below. In deciding which one to pursue, the debtor should consider who is filing the case and what the debtor hopes to accomplish.

What Happens When You File For Bankruptcy In Oregon?

When a bankruptcy petition is filed at the clerk’s office, the automatic stay goes into effect immediately. It will prohibit almost all creditors from pursuing collection action against the debtor or the debtor’s property.

The bankruptcy court sends a notice to all creditors informing them of the following:

- bankruptcy filing,

- case number,

- automatic stay

- name of the bankruptcy trustee working on the case (if filed under chapter 7, 12, 13, or subchapter V of chapter 11)

- date set for the creditors’ meeting

- deadline (if any) for filing objections to the debtor’s discharge and/or the dischargeability of specified debts

- whether and where to file claims

The specific information in the notification is determined by the chapter which the lawsuit is filed under.

If the debtor resides near Portland or Eugene, the meeting of creditors is normally convened within 25 to 40 days after filing, or between 25 to 60 days if the meeting is held elsewhere in the state. At the meeting, the debtor is expected to reply under oath to questions from the bankruptcy trustee as well as any inquiries from creditors on the debtor’s financial status and assets. The debtor is required to attend this conference, although a creditor is not required to do so.

What Happens In A Chapter 7 Case: Liquidation

Chapter 7 bankruptcy can be filed by individuals, small businesses, and big companies. Debtors filing for Chapter 7 bankruptcy, often known as “liquidation bankruptcy” or “straight bankruptcy,” are required to liquidate their assets in order to pay off any remaining unsecured debt.

According to Oregon bankruptcy legislation, the federal courts will appoint a trustee who is in charge of selling assets in the order of “absolute priority” as specified in Section 1129(b)(2) of the United States Bankruptcy Code. The list of Oregon bankruptcy exemptions specifies which property the debtor is allowed to keep – they would never be required to sell all they own. All remaining debts are legally discharged (removed) when the assets are sold.

In a Chapter 7 case involving a single debtor, creditors normally have 60 days from the first date scheduled for the creditors’ conference to object to the discharge of all of the debtor’s obligations and/or the dischargeability of a particular debt. If no challenges to the debtor’s discharge of all obligations are lodged by the deadline, the court will issue a discharge order.

If any objections to the dischargeability of particular debts are raised, the court will hear them, but they will not prevent the court from issuing a discharge for other obligations. An objection to discharge or the dischargeability of specific debts is treated as a separate lawsuit (an adversary proceeding) inside the bankruptcy case, and it may lead to a trial before the judge assigned to the case. Corporate and partnership debtors in Chapter 7 do not get discharges.

If there are no estate assets available to pay a dividend to creditors, the trustee files a report of no distribution and the case is closed. If there are non-exempt assets, funds are available for distribution. The bankruptcy court establishes claim deadlines and informs all creditors of the need to file proofs of claim. The trustee then goes about collecting assets, liquidating them, and distributing the proceeds to creditors.

What Happens In A Chapter 13 Case: Repayment Plan

Individuals and businesses can both file for Chapter 13 bankruptcy. It is a great alternative for anybody who wants to keep all of their property. Also known as “repayment plan bankruptcy” or “debt adjustment bankruptcy,” the debts will be paid back over the following three to five years. This means that the debts will exist for up to five years, but you will be able to keep everything exempt and non-exempt property.

Creditors are granted the right to object to the plan in a chapter 13 case. If no objections are lodged by creditors or the bankruptcy trustee, the plan may be confirmed. Once the plan is confirmed, the trustee will distribute to creditors the proceeds of the debtor’s plan payments until the debtor completes the plan or the court dismisses or converts the case.

When the chapter 13 plan payments are completed, the court issues a discharge order, the trustee makes a final report, and the case is closed. A discharge may be granted if certain criteria are met.

What Happens In A Chapter 12 Case: Family Farmers

Chapter 12 bankruptcy is only used by family farmers and fishermen who have a steady yearly income. This type of bankruptcy, like Chapter 13, operates by creating a repayment plan to pay all unpaid debts back to the debt collection agencies. The repayment programs are available for up to five years, during which time, business can continue as usual.

The confirmation hearing in a chapter 12 case must be concluded within 45 days of the bankruptcy plan’s filing. If a plan is not confirmed, the bankruptcy court may consider dismissing the case. If confirmed, the bankruptcy trustee distributes the debtor’s payments and ensures that the farming operation runs successfully.

When the chapter 12 plan payments are completed, the court issues a discharge order, the trustee makes a final report, and the case is closed. A discharge may be granted if certain criteria are met.

What Happens In A Chapter 11 Case: Large Reorganization

Chapter 11 bankruptcy is often reserved for big companies. Individuals with extraordinarily large outstanding debts, on the other hand, can petition for this form of claim too. The unpaid amount is not immediately paid through the sale of assets in a “reorganization bankruptcy”. Instead, the court-appointed trustee restructures the debts while business as usual continues.

The bankruptcy laws in Oregon require the debtor to repay their debts with the company’s future income, but it does give an opportunity for the corporation to emerge as a thriving business. If the company is unsuccessful, it will be forced to file for Chapter 7 bankruptcy to pay any outstanding debts.

The debtor meets with the U.S. Trustee’s staff before the creditors’ meeting in a chapter 11 case. During the meeting, the U.S. Trustee examines the debtor-in-possession’s responsibilities and restrictions, explains the quarterly fees and monthly operating reports, and generally discusses the debtor’s financial situation and the breadth of the anticipated plan of reorganization.

The U.S. Trustee encourages interested unsecured creditors to organize a creditors’ committee and play an active role in pushing the case forward. Before votes for and against the plan can be sought in most chapter 11 cases, a disclosure statement must be filed with the plan and approved by the court.

The court makes a final decree closing the case when the estate has been fully administered. Before the payments required by the plan are made, a chapter 11 estate may be declared fully administered and closed.

Call Now For An Appointment For A Free Debt Solutions Consultation!

We believe so passionately in our holistic solution to bankruptcy that we are not only providing a free debt recovery program to all new customers, but also to old customers. There is simply no quicker way to rebuild credit after a bankruptcy in Oregon than by filing your bankruptcy case with Northwest Debt Relief Law Firm.